PON equipment sales up 9%, Ethernet FTTH up 10% in 1Q07

CAMPBELL, California, June 27, 2007—Worldwide passive optical network (PON) equipment sales sequentially grew 9% in the first quarter of 2007, reaching $336 million, says Infonetics Research in its PON and FTTH Equipment and Subscribers report.

Worldwide Ethernet FTTH equipment revenue is also up 10% from 4Q06, hitting $81 million in 1Q07.

The report identifies 4 major trends driving the PON and Ethernet FTTH equipment markets, all related to strong competition:

- Service providers are upgrading their networks to compete with cable and satellite providers and to support the demand for video, online gaming, P2P networking, and other bandwidth-intensive applications

- Content providers are offering new on-demand and broadband video services that eat up more bandwidth into the home

- Residential and commercial developers are trying to outdo the competition with better and more high tech offerings

- Municipalities around the world, most notably in Amsterdam, Stockholm, and Dubai, are upgrading their networks to Ethernet FTTH to keep and attract new jobs in an age where access to digital information is paramount

“FTTH component suppliers are constantly innovating to bring down the cost of FTTH ports, making the ROI for service providers who deploy FTTH a lot faster. Meanwhile, service providers continue to successfully sign up FTTH subscribers, both in Asia Pacific and North America. A growing number of service providers are becoming convinced that FTTH is the only way they can continue to supply the applications digital homes will demand over time,” said Jeff Heynen, directing analyst at Infonetics Research.

Other report highlights:

- Asia Pacific remains the major action point for PON (accounting for 86% of all subscribers), particularly Japan; Korea is on track to add 700,000 to 800,000 EPON subscribers by the end of 2007

- EPON subscribers make up 64% of worldwide subscribers, BPON 33%, GPON 3% in 2006

- In North America, Verizon will begin transitioning to GPON in 3Q07, and currently has over 500,000 FiOS TV subscribers

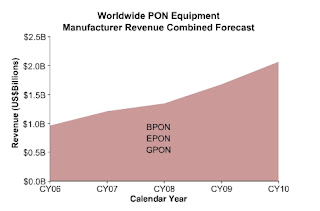

- Asia Pacific’s share of PON revenue will decrease in 2008 as Verizon, AT&T, France Telecom, and Telefonica GPON deployments hit volume

- Tellabs, with its ongoing shipments to Verizon, maintains its strong lead in BPON revenue market share in 1Q07; Hitachi is a distant 2nd, followed closely by Motorola

- Mitsubishi leads in the EPON market, followed by Sumitomo and Fujitsu

No comments:

Post a Comment