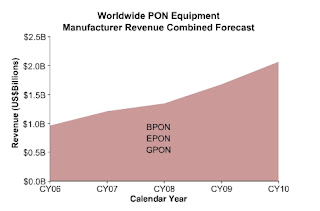

"Over the next five years, we expect the PON market will continue to be concentrated in Asia and North America, but also believe we'll start seeing significant deployments in parts of Europe," said Tam Dell'Oro, founder of Dell'Oro Group. "The market drivers differ between geographic regions. For example, deployments in Japan and Korea benefit from favorable government policy, while shipments in the U.S. are driven by traditional telecom operators, such as Verizon, offering TV services that are competitive with those offered by cable operators. In Europe, we believe PON deployments will be most significant in countries, such as France, where competition is strong from alternative operators."

Tuesday, July 31, 2007

Asia and the U.S. will drive PON over the next five years, says Dell'Oro

Monday, July 30, 2007

Verizon earnings up 4.5 percent

By PETER SVENSSON,

Verizon Communications Inc. on Monday reported second-quarter earnings that rose 4.5 percent from a year ago, mainly due to its successful cell phone division. The results met analysts' expectations.

Verizon, the country's second largest telecommunications company, earned $1.68 billion, or 58 cents per share, in the March to June period, up from $1.61 billion, or 55 cents per share, in the same quarter last year.

Last year's figure included the earnings from a number of business that have since been sold or spun-off, including the high-margin Yellow Pages business. Excluding those businesses, earnings in last year's second quarter were 43 cents per share.

Analysts polled by Thomson Financial were expecting earnings of 58 cents a share in the most recent quarter.

Revenue rose 6.3 percent to $23.3 billion.

Meanwhile, Verizon Wireless said Monday it has agreed to buy Rural Cellular Corp., which provides cell phone service in 15 states under the Unicel brand, for $757 million, or $45 per share.

That's a hefty premium over the $31.81 price for Rural Cellular shares at Friday's close, but the stock hit a high of $46.34 in early July, fueled by acquisition speculation.

In morning trading, the stock soared to $42.67.

Rural Cellular, based in Alexandria, Minn., has 716,000 subscribers. Some of them use phones with the same technology that Verizon Wireless uses, called CDMA, while others use GSM phones compatible with AT&T's and T-Mobile USA's networks.

Verizon Wireless said it plans to convert the GSM subscribers to CDMA service, but will maintain the GSM network for roaming by subscribers of other carriers.

Verizon is taking on about $1.9 billion in debt along with the acquisition, but said it expected the acquisition to save it $1 billion in roaming fees and operations expenses. Verizon Chief Executive Ivan Seidenberg said he sees the acquisition closing in the first half of next year.

Verizon shares fell 70 cents, or 1.6 percent, to $41.30 in midmorning trading.

Telecom analyst Thomas Watts at Cowen & Co. attributed the drop to traders selling the acquirer and buying the acquired, a common strategy. As contributing factors, he pointed to Verizon reporting somewhat more phone line losses than expected, along with weak broadband sales.

But overall, he said, he came away with "a positive feeling in the quarter," and sees the company continuing to boost its earnings.

Verizon Wireless added 1.6 million new customers in the second quarter, but lost 300,000 through the bankruptcy of Amp'd Mobile, which bought wholesale access to Verizon Wireless' network and resold it. Verizon Wireless ended the quarter with 62.1 million subscribers, just short of AT&T's 63.7 million.

Verizon Wireless is a joint venture of Verizon Communications and Vodafone Group PLC of Britain. All of its revenue is counted on Verizon Communications' books, but only 55 percent of its profits — the rest go to Vodafone.

Addressing competition from Apple Inc.'s iPhone, a much hyped handset introduced a month ago exclusively on AT&T's network, Verizon President and Chief Operating Officer Denny Strigl acknowledged the company has "seen an impact" on the rate of subscribers porting numbers to and from Verizon Wireless.

However, Strigl said, the company last week returned to adding two cellular customers for every one that it loses.

On the wireline side, revenues declined 1.1 percent to $12.6 billion, as Verizon kept losing former MCI long-distance customers and traditional copper phone lines.

However, retail customers in Verizon's local-phone service area spent almost 11 percent more, or an average of $57.47 per month, as they signed up for broadband Internet service via fiber optics.

The fiber-optic broadband service, FiOS, added 203,000 subscribers in the quarter for a total of 1.1 million. Of those, 515,000 were also signed up to get TV through the fiber, a tenfold increase from a year ago.

For the first time, Verizon signed up more subscribers to get broadband Internet service through FiOS than through the copper lines for DSL, or digital subscriber line.

It added just 85,000 DSL subscribers, down from 239,000 in the first quarter.

"Frankly, we weren't as focused as we used to be on DSL for the quarter," Strigl said. "We have taken a lot of the technicians and the service reps that used to work DSL and tried to quickly get them up to speed on FiOS."

Strigl said the company aims to get DSL customer recruitment numbers back up.

Thursday, July 26, 2007

Flexible Fiber permits precise CO2 laser delivery.

July 10, 2007

For the first time, safety and precision of CO2 laser energy can be delivered through a user-friendly, flexible fiber for otology surgery.

CAMBRIDGE, Mass. July 10 -- OmniGuide, Inc. (www.omni-guide.com) today announced the commercial availability of its new OtoBeam flexible CO2 laser fiber and intuitive handpiece product line for use in otology procedures. The clinical benefits of CO2 laser energy namely precision cutting and coagulation with minimal thermal spread previously had limited applications in otology due to the absence of a flexible delivery system. OmniGuide's breakthrough flexible CO2 laser fiber product for the first time allow this beneficial energy source to be placed at the surgeon's fingertips for accurate control when operating on the delicate structures of the middle and inner ear. OmniGuide's OtoBeam CO2 laser fiber technology opens the way for the broad use of CO2 lasers in otology applications.

Annually, approximately 30 million people are diagnosed with hearing loss due to otosclerosis, and 300,000 people in the U.S. suffer hearing loss as a result from otosclerosis. CO2 laser energy has been widely established as a precise and safe laser wavelength due to rapid absorption by the water-like perilymph present in the inner ear, resulting in minimal thermal spread. These characteristics make the CO2 laser a highly desirable tool in stapedectomy procedures. To date however, the use of CO2 lasers in such procedures has been severely limited due to the absence of a flexible fiber. OmniGuide's breakthrough photonic bandgap fiber technology allows this beneficial laser energy to be guided through a flexible fiber.

Anand K. Devaiah, MD, Assistant Professor in the Department of Otolaryngology at Boston University School of Medicine, performed some of the first otology procedures with the OtoBeam fiber. According to Dr. Devaiah, "The OmniGuide OtoBeam flexible fiber attached to a CO2 laser is an effective and adaptable tool for use in stapedectomy. By reducing the risk to the inner ear with laser energy that does not penetrate beyond perilymph, the safety of CO2 laser energy can be coupled with the ease of fiber delivery."

Prof. Yoel Fink, OmniGuide's cofounder further commented that, "The OtoBeam product line is the result of a major technology breakthrough in our photonic bandgap fiber technology. We believe that the OtoBeam flexible CO2 laser fiber provides the surgeon with a flexible, precise, safe, and intuitive device in stapedectomy procedures. The OtoBeam fiber offers unparalleled accuracy and a high degree of control over penetration into target structures and formation of the footplate rosette. These attributes are critical in stapes surgery."

About OmniGuide Technology

The OmniGuide OtoBeam and BeamPath systems are FDA-cleared devices, and have treated over 600 patients in approximately 100 U.S. medical facilities. CO2 laser energy offers unparalleled precision and a high degree of control over penetration into soft tissue. These attributes are critical in otology, laryngology, head and neck surgery, and pulmonology procedures for which there is the potential to damage delicate untargeted structures. 20,000 CO2 lasers have been deployed in operating rooms throughout the world. However, until now, CO2 lasers have limited applications to invasive surgery due to the absence of a fiber delivery system at their wavelength of operation.

The key to OmniGuide's technology is a revolutionary photonic bandgap fiber that was originally invented and developed at MIT. The company holds an exclusive license from MIT and has added an extensive portfolio of related US and international patents. The technology was first published in Nature in 2002.

Learn more about there products here.

Fiber to the premises: Eight lessons learned

More than 1,000 communities in North America currently enjoy FTTP deployments as their service infrastructure. Although this number represents only a small fraction of the homes in the U.S.—around 1%—clear lessons have emerged as to which critical factors lead to the success or failure of these deployments.

By David Russell, Calix

FSAN grew over time to encompass 23 network operators with more than 450 million subscribers. The group initially developed an ATM-based standard known as broadband passive optical network (BPON) and later an Ethernet-based standard known as Gigabit PON (GPON), or ITU G.984.

Today, we are witnessing the fruition of this vision. FTTP is now cost effective and considered an absolute necessity for the survival of telephone companies competing against cable multiple-systems operators (MSOs). With FTTP now serving more than 1 million subscribers in North America, it is finally hitting the inflexion point in the growth curve.

More than 80% of North American FTTP deployments are based on the FSAN standards. Although BPON initially dominated the market, GPON now is eclipsing the earlier standard, much like DVD replaced VHS. U.S.-based FTTP deployments can be grouped into six major types, each with its own market drivers and unique characteristics. But underpinning all successful deployments are some common lessons.

FTTP deployment type 1: Verizon

For obvious reasons, most of the press attention in North America has focused on the FTTP deployments by Verizon. Verizon today accounts for the majority of FTTP deployments in North America and represents the world's largest FTTP project aside from NTT's in Japan. Verizon aims to deliver a complete communications, information, and entertainment package to subscribers in the major metropolitan areas it serves. The carrier delivers its services to geographically targeted areas in its footprint, regardless of whether the homes are in greenfield or brownfield areas.

The Verizon deployments underscore three key lessons that can be learned from all successful FTTP projects in North America:

Lesson 1: Offer multiple services to consumers in packages. Service bundling is a big hit with consumers and has proven to lower churn.

Lesson 2: Create strong marketing and branding around the FTTP offering. Competition among service providers is intense. Most consumers are not "techies" but base their decisions on marketing—and customer service.

Lesson 3: Provide one-of-a-kind services and content. Selling "me too" video or voice services does not provide long-term differentiation. Unique video content can be the difference between mediocre and great; just look at DIRECTV's "NFL Ticket."

FTTP deployment type 2: ILEC greenfields

The Verizon deployment is unique among those by large ILECs in its focus on overbuilding areas of existing copper plant. The other large ILECs (AT&T, Qwest, Embarq, and others) consider FTTP primarily for new builds. These companies have proven that FTTP is more cost-effective than copper for new construction—even when no incremental services are offered over FTTP. However, these largest ILECs have struggled to define and execute a consistent approach to video services, which has had a negative impact on take rates and overall rollout of FTTP. This negative impact highlights a fourth key lesson learned from successful FTTP deployments:

Lesson 4: Get the video service right. FTTP deployments are defined by the successful rollout of video services. Video is sticky and is a low-margin leader for high-margin data and voice services.

FTTP deployment type 3: Developer integrators

Even with the depressed housing market in the United States, more than 1.5 million new homes will be built in 2007. Most new home construction is taking place in California, Florida, and other sunbelt states. Today, more than 50% of all new homes are built in master planned communities. A new type of service provider has emerged to provide a complete package of voice, data, and video services to these self-contained communities. These include companies active across many states, such as PrimeVision and Zoomy Communications, as well as companies with more of a geographic focus, such as Greenfield Communications in the west and OpenBand in the Washington, DC, metropolitan area.

A recent study by market research firm Render, Vanderslice and Associates found that FTTP is becoming the dominant technology for serving master planned communities. From the developers' perspective, FTTP provides an additional amenity to attract buyers to the property. Increasingly, however, it is the consumer who is demanding the most up-to-date communications and entertainment infrastructure. Many home buyers in these new planned communities are moving from areas with broadband services, and they are demanding the best technology possible in their new homes.

This consumer-driven demand brings to light another key lesson:

Lesson 5: Consumers will use the bandwidth available to them. Operators wishing to build loyal customers should provide generous data bandwidths over FTTP. Limiting bandwidths to DSL or cable modem rates depreciates the value proposition of FTTP.

FTTP deployment type 4: Independent telephone companies in rural/exurban areas

Ironically, residents of major metropolitan areas often are envious when they hear about the services available to residents in many rural areas. Independent telephone companies have been among the most innovative operators in rolling out new video services such as IPTV over FTTP networks. Today, more than 400 rural communities in the United States have state-of-the art FTTP networks provided by their local telephone companies. The broadband loan program administered by the Department of Agriculture has encouraged these deployments to ensure that rural communities are able to enjoy broadband services.

A map of these rural deployments reflects where independent telephone companies dominate the operator landscape: Minnesota, Iowa, Texas, and other states with lower-density areas that the RBOCs were not interested in serving.

But many of these independents now find themselves located near the highest-growth areas of the country. As metropolitan areas have experienced explosive growth over the past 30 years, the exurban areas of many U.S. cities and resort areas now extend out to counties served by independent telephone companies. Examples include FTTP deployments in high-growth perimeters outside of Myrtle Beach, SC, (Horry Telephone) and near San Antonio, TX (GVTC).

Other independents took matters into their own hands. Instead of remaining locked in a slow-growth territory, some independents have chosen to deploy FTTP well outside their ILEC service area to gain access to higher-density and higher-growth communities. By becoming an FTTP CLEC, Oxford Utilities of Maine reinvented itself and is now a major operator in the Portland-to-Augusta corridor.

Lesson 6: The provider that brings fiber to a community first becomes the dominant provider to that community. No other provider is likely to invest the capital required to compete when another operator has already wired the community with fiber.

FTTP deployment type 5: Pure FTTP CLECs

The competitive advantages offered by FTTP have created a new type of competitive-access carrier in many Tier 2 and Tier 3 cities in the U.S. These CLECs have seized on the promise of fiber and built out FTTP networks to both businesses and residences. Many of these operators start with business customers, generate positive cash flow, and then extend their service to nearby residences. Once they have a proven business model in an initial city, these operators will extend the model to other towns and cities in the region. Successful examples include Mahaska of Oskaloosa, IA, and Omnilec of Peoria, IL.

Lesson 7: Serving business customers is a critical component of a successful FTTP deployment. After the collapse of many CLECs during the technology crash in 2000, the media and many investors stopped following the CLEC market. But FTTP has given new life to a whole new generation of highly differentiated operators that own their own fiber networks and are using the FSAN GPON standard to compete effectively against the largest ILECs.

FTTP deployment type 6: Municipalities

The construction of FTTP networks by municipalities has attracted a great deal of media attention. Front-page articles in The Wall Street Journal have chronicled the proposal by Lafayette, LA, to build its own municipal FTTP network. To date, fewer than 40 towns and cities in the U.S. have built or approved construction of city-owned FTTP networks. But increasingly cities and towns are viewing FTTP as a critical component in economic development. Those cities that are not on the list for FTTP construction by an RBOC are searching for alternative providers (a nearby independent or CLEC). If unable to find a private entity to take on the project, some municipalities are opting to build their own networks. On the larger side, for example, Burlington, VT, has successfully rolled out a complete package of high-speed data, voice, and IPTV services to its residents. On the smaller side, the city of Windom, MN, has been very successful in launching its triple-play network over GPON.

Some municipal deployments have not been successful, slowed by political problems and communities not used to operating their own utility and communication services. These failures highlight the final FTTP lesson:

Lesson 8: Do not underestimate the technical expertise required to operate a state-of-the-art network. Successful operators invest in good technical staff and back-office systems for handling technical support, billing, and customer care. Municipalities should not see FTTP as some sort of panacea or quick solution for economic development. But as a last resort, when a municipality is frustrated by a lack of commitment from its incumbent operators, FTTP may be the best choice for assuring its citizens receive quality triple-play services.

FTTP now is moving to the mass-deployment stage. It is still considered cutting edge and the best technology available today, but it is no longer "bleeding edge." The basic tenets of a successful FTTP deployment are known and understood, thanks to the operators that pioneered the deployment of FTTP technology. And these operators now enjoy the position of being the dominant service providers in their chosen markets.

Increasing fiber in cable's diet

Wednesday, July 25, 2007

AWG companies announce small form factor MSA

JULY 24, 2007 -- Planar Lightwave Circuit vendors NEL, Hitachi Cable, Gemfire, Fitel, NEC, and NeoPhotonics have announced the addition of a new option within the Multi-Source Agreement (MSA) for thermally stabilized array waveguide grating modules for a small form factor package configuration.

This small form factor module provides a footprint approximately one third smaller than the original AWG MSA, first published in December of 2002, depending on the configuration, say MSA members. These standardized AWGs provide multiplexing and demultiplexing for DWDM optical equipment through a common interface, allowing equipment manufacturers a choice among several compatible suppliers, simultaneously reducing lead-times and cost, say the companies.

The new small form factor provides all of the benefits of standardization while saving precious board space. Version 2.0 of the MSA, containing descriptions of both the standard and small form factor AWG packages, has now been published. For more information, visit the AWG MSA website at www.awgmsa.com.

"As one of the founding members, we at NEL have been very pleased with the broad industry acceptance of the initial MSA for thermally stabilized AWGs, and we expect this Small Form Factor MSA to be equally successful," asserts Haruki Kozawaguchi, executive director of NEL Corp. He notes that the MSA defines common mechanical features and electrical interfaces for the AWG module, including package dimensions, bolt holes, electrical pin positions and assignments, fiber positions, heater resistance, and firmware. By contrast, optical performance parameters such as insertion loss, crosstalk, and passband are not specified by MSA, says Kozawaguchi. Instead, they are determined individually by the member companies.

AWG technology has advanced greatly since the original AWG MSA was defined in 2002, recalls Seiich Okubo, CTO of Hitachi Cable. "An AWG with the same number of channels and channel spacing can now be put in a package that is only two thirds of the size of the original," he reports. "This new Small Form Factor MSA package will allow equipment manufacturers to utilize this small size while retaining the benefits of a standard mechanical and electrical interface."

Nigel Cockroft, vice president of telecom products at Gemfire Corp. maintains that the new small form factor AWG agreement is a great simplification over the original MSA, "by providing a single slim, compact form factor for two choices of input/ output fiber locations while allowing for either internal or external electronic control. Given the rapidly increasing deployment of AWGs and pressures to minimize system space," he says, "we expect this new design will be very popular and will allow system integrators to move forward with confidence."

It is important that MSA standards keep pace with technology developments, adds G. Ferris Lipscomb, vice president of marketing at NeoPhotonics. He believes the new small form factor MSA enables equipment manufacturers to benefit from the development of small form factor technology, but contends that the original MSA will continue to be supported, "because many systems worldwide are based on that standard."

The thermally stabilized AWG MSA group is an open forum, welcoming applications from AWG manufactures that wish to join.

PON equipment sales up 9%, Ethernet FTTH up 10% in 1Q07

PON equipment sales up 9%, Ethernet FTTH up 10% in 1Q07

CAMPBELL, California, June 27, 2007—Worldwide passive optical network (PON) equipment sales sequentially grew 9% in the first quarter of 2007, reaching $336 million, says Infonetics Research in its PON and FTTH Equipment and Subscribers report.

Worldwide Ethernet FTTH equipment revenue is also up 10% from 4Q06, hitting $81 million in 1Q07.

The report identifies 4 major trends driving the PON and Ethernet FTTH equipment markets, all related to strong competition:

- Service providers are upgrading their networks to compete with cable and satellite providers and to support the demand for video, online gaming, P2P networking, and other bandwidth-intensive applications

- Content providers are offering new on-demand and broadband video services that eat up more bandwidth into the home

- Residential and commercial developers are trying to outdo the competition with better and more high tech offerings

- Municipalities around the world, most notably in Amsterdam, Stockholm, and Dubai, are upgrading their networks to Ethernet FTTH to keep and attract new jobs in an age where access to digital information is paramount

“FTTH component suppliers are constantly innovating to bring down the cost of FTTH ports, making the ROI for service providers who deploy FTTH a lot faster. Meanwhile, service providers continue to successfully sign up FTTH subscribers, both in Asia Pacific and North America. A growing number of service providers are becoming convinced that FTTH is the only way they can continue to supply the applications digital homes will demand over time,” said Jeff Heynen, directing analyst at Infonetics Research.

Other report highlights:

- Asia Pacific remains the major action point for PON (accounting for 86% of all subscribers), particularly Japan; Korea is on track to add 700,000 to 800,000 EPON subscribers by the end of 2007

- EPON subscribers make up 64% of worldwide subscribers, BPON 33%, GPON 3% in 2006

- In North America, Verizon will begin transitioning to GPON in 3Q07, and currently has over 500,000 FiOS TV subscribers

- Asia Pacific’s share of PON revenue will decrease in 2008 as Verizon, AT&T, France Telecom, and Telefonica GPON deployments hit volume

- Tellabs, with its ongoing shipments to Verizon, maintains its strong lead in BPON revenue market share in 1Q07; Hitachi is a distant 2nd, followed closely by Motorola

- Mitsubishi leads in the EPON market, followed by Sumitomo and Fujitsu

Tuesday, July 24, 2007

Corning develops ultra-flexible fiber optics

The world's largest maker of optical fiber said Monday it has developed a new fiber that is at least 100 times more bendable than standard fiber, clearing a major hurdle for telecommunications carriers drawing fiber into homes.

"This is a game-changing technology for telecommunications applications," said Corning's president, Peter Volanakis. "We have developed an optical fiber cable that is as rugged as copper cable but with all of the bandwidth benefits of fiber."

Three Corning scientists invented low-loss optical fiber in the early 1970s. The gossamer-thin strands of ultra-pure glass delivering voice, video and data at the speed of light have replaced copper as the backbone of America's telephone and cable television networks and enabled the phenomenal growth of the Internet.

Current optical fiber doesn't carry light well when it is bent around corners and routed through a building, making it difficult and expensive to run fiber all the way to homes and businesses. The ultra-flexible technology allows the fiber to be bent with virtually no signal loss, Corning said.

Corning said the improvements will enable carriers to economically offer high-speed Internet, voice and high-definition TV service to virtually all high-rise buildings.

In standard fiber, the light signal leaks out at bends or turns and "with two 90-degree turns, the signal is lost," Corning spokesman Dan Collins said. "This design relies on nanostructures that serve as a mirror or a guardrail, and as the fiber is turned or bent, the light doesn't leak out. We have wrapped the fiber around a ball point pen and it retains its effectiveness."

Michael Render, a market researcher in Tulsa, said the new product "would be an important breakthrough" in fiber-to-the-home systems.

More than 1% of North American homes are now directly connected to fiber, but many of them are single-family dwellings, Render said.

"There obviously are a large number of people that live in multi-tenant buildings, and improvements in the way to get fiber to those individual living units could be very significant," he said.

Render said the technology would make it easier to bring fiber "all the way to each individual living room, for example, or at least to each floor," instead of taking it only to the basement and then using existing wiring to reach the living unit.

There are more than 25 million high-rise apartment homes in the United States and more than 680 million worldwide. "The high cost of installation and difficulty in delivering fiber to the home made this market unappealing to most providers," Volanakis said in a statement.

Corning formed a working team with New York-based Verizon Communications in February to tackle the problems of installing fiber in multiple-dwelling buildings. Verizon is the only major U.S. phone or cable company to aggressively draw fiber to existing homes.

"This fiber technology will enable us to bring faster Internet speeds, higher-quality high-definition content and more interactive capabilities than any other platform which exists today," said Paul Lacouture, a Verizon Telecom executive.

Verizon makes tiny dent in TV rollout

Boston Business Journal - July 6, 2007

Verizon Communications Inc., which began selling TV service in Massachusetts last year with great fanfare, still has a long way to go to overtake Comcast Corp., the state's largest cable TV provider.

Verizon (NYSE: VZ) had 11,983 video customers as of Dec. 31 -- about the same number as Shrewsbury's municipal cable operator and far less than rivals Comcast and RCN Corp., according to documents filed with state regulators. RCN Corp. had more than 63,000 subscribers and Comcast (Nasdaq: CMCSA) had 1.6 million.

The figures underscore the fact that despite all the attention Verizon's launch has garnered, it will take Verizon time to secure local franchises, build out its new fiber-optic network and lure customers away from cable and satellite providers. Indeed, Verizon's FIOS TV service is still only available to 280,000 of the state's 2.5 million households, up from about 200,000 at year-end. And it took cable providers decades to build their networks and customer bases. Verizon first launched video service in Woburn on Jan. 24, 2006, and has since rolled out the service to 43 other cities and towns in the state.

"There is nothing you wouldn't expect in the first year of a rollout,'' said Verizon spokesman Phil Santoro. He said Verizon has exceeded its internal expectations for sales in the state. The company hasn't publicly announced any targets for Massachusetts sales.

Comcast spokesman Jim Hughes, though, said the figures show Comcast is continuing to dominate the state's pay TV business.

"Verizon is playing catch-up while we continue to innovate and to grow our business here in Massachusetts,'' Hughes said.

Regardless, Comcast and other providers are watching Verizon closely. Verizon, the state's largest phone company, already has an enormous base of phone and Internet customers, a well-known brand name and enormous marketing muscle, which could help it expand quickly. Verizon is marketing its FIOS service through television, radio and print ads, as well as direct mail and door-to-door sales. Meanwhile, cable providers are trying to encroach on Verizon's traditional turf by offering phone service. And both cable and phone providers have long competed head-to-head by offering high-speed Internet service.

So far, Verizon has signed up fewer video customers in Massachusetts than in several other states it serves. According to the company's own figures, the firm had a penetration rate of 6 percent in Massachusetts as of year-end, compared to a penetration rate of 9 percent overall.

But Santoro said the figures are skewed because Verizon ramped up service earlier in many other states. Indeed, in most of the towns Verizon served last year in Massachusetts, it only started offering service in the second half of the year, giving it less time to sign up customers. Santoro also said it's important to factor in how much money Verizon is spending on marketing in Massachusetts compared to other states. But he refused to divulge those figures.

Verizon has fought to keep its local subscriber figures under wraps, refusing to tell reporters and asking the state to keep the numbers confidential; Verizon said it needs to keep the data secret to avoid tipping off competitors about its roll-out. But other cable providers opposed the request, saying the figures have long been public for other cable TV providers. And in a ruling last month, the state Department of Telecommunications and Cable rejected Verizon's request. DTC Commissioner Sharon Gillett pointed out that figures for individual towns were already publicly available from each municipality, and cable providers had a good idea where Verizon stood.

"Since the numbers are either generally known to the industry or easily acquired through appropriate means, the number of subscribers Verizon serves in a particular community is not a trade secret," Gillett said.

According to the state filings, Verizon signed up the largest number of customers in Woburn and Reading, where it has offered the service the longest. In Woburn, it had 1,355 customers. And it had 1,365 in Reading. By contrast, Verizon had only a handful of customers in towns like Natick and Littleton, where it just launched service in December.

Nationwide, Verizon said it had signed up nearly 500,000 FIOS TV customers in 11 states nationwide as of June 20. Verizon also signed up another 618,000 customers for DirecTV's satellite service by the end of March. Verizon declined to provide comparable figures for Massachusetts.

See a related article here about FiOS coming to Rockland, MA

Ladies and Gentlemen...Here's Fiber

This is not just for the telecommunications industry, but for research, medical, industrial, security and any other industries that use fiber optics. We can all learn from each other and we can better our own professions and products by learning about what others are doing.

Stephen